Report: The Magnificent Seven

As the biggest-ever platform shift in modern technology unfolds, together with D...

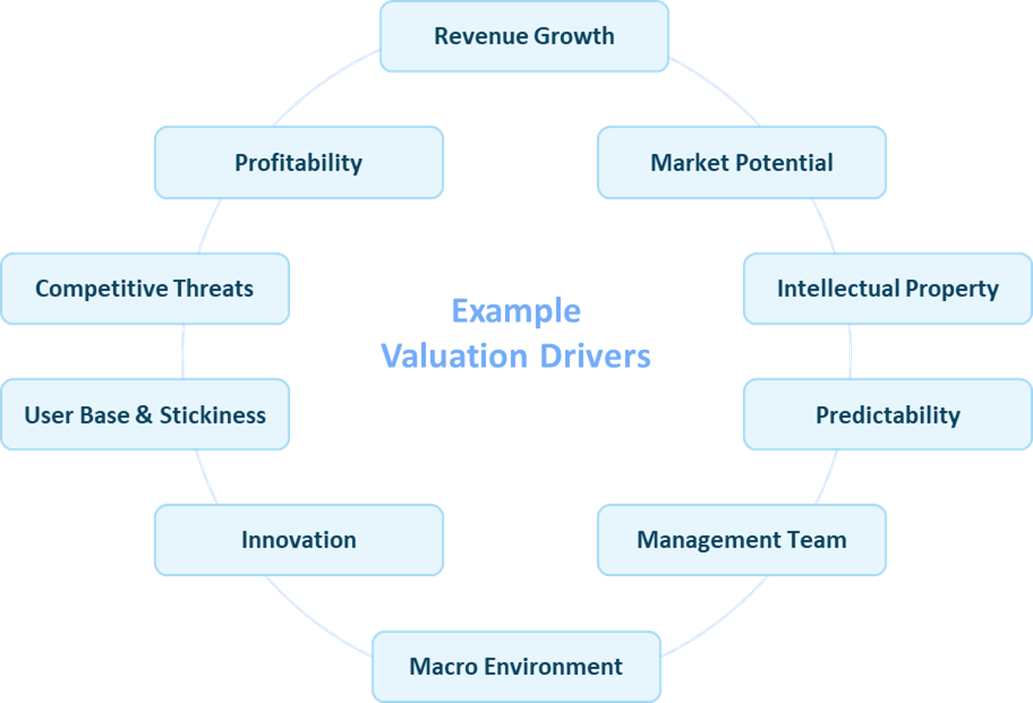

Company valuation is a key aspect of corporate finance that is used to determine the worth of a complete business or a selection of assets. The process considers various factors which could impact future performance including the management team, growth prospects, industry trends, competitive landscape and long-term defensibility among others which are summarised to an estimated range.

While principles of valuation are scientific in nature, various stages of the process require extensive assumptions of what might impact a firm's performance or the wider industry in years to come - which ultimately means that a blend of valuation methodologies is usually best practise.

Absolute valuation: fundamentals-based approach which focuses on an asset's future potential for income generation. All factors impacting the business, such as growth potential and industry pressures need to be reflected in company's financial forecast which is a key input for absolute valuation models. Most common ones are discounted cash flow, dividend discount and asset-based.

Relevant analogy here would be a financial approach which considers the perpetual rental income considering factors such as general inflation, neighbourhood prospects, maintenance requirements etc.

Relative valuation: ratio-based approach which looks at the value assigned by the market on key metrics i.e. the market value per dollar generated of revenue, EBITDA, free cash flow or even an operating metric (e.g. active users, installs, web traffic). Can either be derived by looking at data from publicly-listed companies or from precedent transactions in a similar space.

Good analogy in this example would be looking at comparable houses in the neighbourhood and applying a "price per square foot" multiple on the plot size.

Limited information usually makes the valuation process more of an art than a science, as it often requires plenty of smart assumptions to ultimately deliver an accurate valuation estimate. Finding the right public companies to use as a benchmark, the most relevant transactions in recent years (and adjusting them for current times) or critically challenging a business plan from the perspective of a potential investor can be a challenging task.

Digital companies often add a layer of complexity to the valuation process, as their rapid growth impacts both absolute (difficulties in forecasting fundamentals) and relative (wide range of multiples) valuation techniques. As a first step, it's key that the forecast used for valuation purposes is as realistic as possible - and it usually makes sense to analyse various scenarios with sensitivity analysis.

The global reach of digital companies combined with a heavy weighting towards intangible assets make for an industry that has high and rapid growth potential, but with significant risk of disruption.

Various stakeholders are likely to place close attention to valuation and on related trends from the early start-up phase all the way to up an exit transaction and beyond -

As there are several factors which impact a firm's performance (see the examples presented above for just a small selection), any change that could materially impact a financial forecast will inevitably have a resulting influence on the valuation. Hence, anything which could be considered news worthy for the firm specifically or the wider industry might require another look.

It's crucial to recognise that valuations will ultimately be for that point in time only - and this is even more important for the fast-growing and ever evolving companies in the technology space.

As the biggest-ever platform shift in modern technology unfolds, together with D...

We are formally launching our tech sector coverage in Latin America, an ever-evo...

In conversation with Francisco Loehnert, co-founder and CEO of Awto, an autotech...

In conversation with Gabriela Estrada, co-founder and CEO of Vexi, a neobanking ...

2023 has been a wild ride in tech. From the rise of gen AI to public valuation m...

We checked in on the data and trends driving the global startup, tech and ventur...

We partnered with Dealroom to deliver the latest update on European tech ecosyst...

With the proliferation of new technologies comes the growing number and complexi...

Beyond understanding the corporate finance principles behind company valuation m...

Software as a Service (SaaS) business model has been around for a while, growing...

ARPPU, or 'Average Revenue per Paying User', is a measurement of the predicted r...

While most management teams tend to be overly optimistic when putting together f...

Company valuation is a key aspect of corporate finance that is used to determine...

South Korea is the fastest growing Asian Tiger nation for VC investment, and Seo...

Deliveroo is reported to target a $10B valuation in an upcoming IPO. In preparat...

In this report, we take a deep dive into the creator economy ecosystem to analyz...

Climate change is one of the most threatening crises of our time and the world n...

This was a pretty crazy year, to say at least. The COVID-19 health crisis, while...