Report: The Magnificent Seven

As the biggest-ever platform shift in modern technology unfolds, together with D...

In conversation with Gabriela Estrada, co-founder and CEO of Vexi, a neobanking platform providing a credit card experience to the rising middle income population in Mexico.

Founded in 2016, Vexi gives underbanked Mexicans access to the financial system via a first-time credit card with a 100% digital experience.

Vexi is based in Mexico City and has raised over $30 million in equity and debt funding from Magma Partners, Redwood Ventures, Rebalance Capital, Accial Capital and other leading venture capital and debt investors.

Vexi stemmed from an in-depth understanding and personal involvement in the Mexican financial industry. With over 15 years dedicated to this sector, we personally witnessed through our own experiences and those of our families, the widespread inequality exacerbated by the industry's inefficiencies. We identified a concerning pattern where millions of individuals were excluded from the system, creating a detrimental cycle: people lacked credit access due to the absence of a credit history, and the lack of credit history resulted in entities' unwillingness to provide credit. This situation left a significant portion of the adult population relying on excessively costly informal loans to address emergencies.

Cinthia (Cinthia Merlos) had devoted half of her professional career to developing new businesses for major international companies. She knew what it was like to start from scratch, not only professionally but also personally. Having learned to build processes, teams, and profits from the ground up, she was convinced that she could use her talent to create something meaningful and bring about a change in her country.

The recognition of this systemic issue served as the driving force behind the decision to establish Vexi. When Gustavo (Gustavo Rojo Blasquez) proposed the idea of creating a company capable of real change, the objective was unmistakable: to disrupt the cycle of financial exclusion by empowering clients to access the formal financial system. Vexi aimed to deliver the advantages of traditional banking, including competitive interest rates, rewards programs, and top of class BNPL network - all through technology developed by their own team.

We all agreed that Vexi's business model was the perfect opportunity to achieve this deep personal purpose.

Since Vexi's launch in April 2018, the fintech landscape in Mexico and Latin America as a whole has undergone significant and transformative changes. The evolution has been marked by several key developments:

Increased recognition and adoption

There has been a notable surge in the recognition and adoption of Fintech solutions among consumers. Vexi with its innovative approach to providing access to formal financial systems, has played a crucial role in contributing to this heightened awareness.

Technological advancements

Rapid advancements in technology, including artificial intelligence, machine learning and data analytics have enabled Fintech companies to offer more personalized and efficient financial solutions. Vexi has likely leveraged these technological developments to enhance its services and improve the overall customer experience.

Increased collaboration

The fintech ecosystem has witnessed increased collaboration between traditional financial institutions and fintech startups. We currently issue an American Express-branded card, which has forged close ties in our relationship with the brand.

Broader financial inclusion

Fintech has played a pivotal role in expanding financial inclusion across Mexico and Latin America. Vexi's mission aligns with this trend, as it aims to break the cycle of financial exclusion by providing accessible and inclusive financial services to a broader segment of the population.

Changing consumer expectations

With the rise of fintech, consumer expectations regarding financial services have evolved. Customers now demand more convenience, transparency, and personalised solutions. Vexi, by addressing these expectations, has contributed to shaping the changing landscape of consumer preferences in the financial sector.

We have become one of the few (or the only) neobank that is already cash positive in Mexico, and soon-to-be profitable. Vexi stands out as a truly successful neobanking product, and its unique differentiators reflect a distinctive position in the financial market. We are the only non-bank credit card in Mexico and one of the very few in Latin America with the prestigious American Express brand. This distinction not only strengthens our credibility but also underscores our commitment to providing high-quality financial services. We outline five key elements that define our uniqueness:

Proprietary technology platform

As certified owners of our payment processors, our own banking core and credit scoring, and with direct licences from Carnet and American Express, we enjoy a significant competitive advantage. This ownership allows us to conduct go-to-market operations more efficiently in terms of time and costs and gives us full control of issuer interchange income, unlike other players outsourcing these processes and retaining only 30% of it.

Exclusive data and risk models

We have custom risk models to address the underserved segment, backed by over 5 years of data and 3 million applications. Our risk ratios are impressive, even during the pandemic, with a remarkably low capital loss of 1.9%.

Operational efficiency

We have successfully handled 3 million applications for our card, approving 1 million customers, all with less than $11 million in raised equity. This operational efficiency translates into a solid business model from day one, with low customer acquisition costs, high retention, and a rapid approach to financial break-even.

Positive unit economics

From the outset, we maintain positive unit economics, supported by effectiveness in customer acquisition, strong retention, and nearing financial break-even.

Experienced founding team

With over 75 years of combined experience in the financial sector, credit cards, technology, and new business development, our founding team brings a comprehensive perspective and a diverse set of skills to drive Vexi's continued success.

We aspire to establish ourselves as the primary financial services platform catering to the underserved population throughout Latin America. Beyond addressing the fundamental need for credit accessibility, our commitment extends to resolving the multifaceted challenges that our customers encounter in their daily lives. Micro-entrepreneurs, in particular, face obstacles such as limited access to personal loans for their businesses, payment solutions, opportunities for savings and investment, remittance services, and insurance tailored to our specific demographic.

While our initial focus involves building trust with our customers through credit offerings, our vision transcends the confines of a traditional credit card service. We are dedicated to expanding our scope to encompass a comprehensive range of financial services, with the ultimate goal of serving the entire Latin American region. By addressing the diverse financial needs of our customers, we aim to make a meaningful and lasting impact on the lives of the underserved, fostering financial inclusion and empowerment across the region.

As the biggest-ever platform shift in modern technology unfolds, together with D...

We are formally launching our tech sector coverage in Latin America, an ever-evo...

In conversation with Francisco Loehnert, co-founder and CEO of Awto, an autotech...

In conversation with Gabriela Estrada, co-founder and CEO of Vexi, a neobanking ...

2023 has been a wild ride in tech. From the rise of gen AI to public valuation m...

We checked in on the data and trends driving the global startup, tech and ventur...

We partnered with Dealroom to deliver the latest update on European tech ecosyst...

With the proliferation of new technologies comes the growing number and complexi...

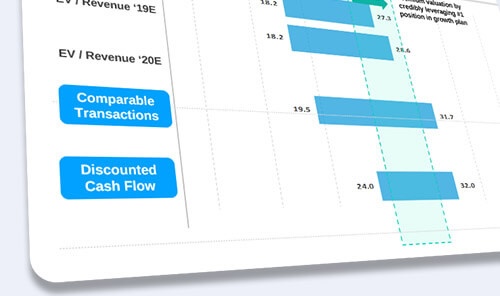

Beyond understanding the corporate finance principles behind company valuation m...

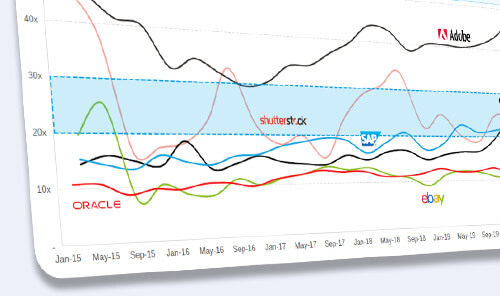

Software as a Service (SaaS) business model has been around for a while, growing...

ARPPU, or 'Average Revenue per Paying User', is a measurement of the predicted r...

While most management teams tend to be overly optimistic when putting together f...

Company valuation is a key aspect of corporate finance that is used to determine...

South Korea is the fastest growing Asian Tiger nation for VC investment, and Seo...

Deliveroo is reported to target a $10B valuation in an upcoming IPO. In preparat...

In this report, we take a deep dive into the creator economy ecosystem to analyz...

Climate change is one of the most threatening crises of our time and the world n...

This was a pretty crazy year, to say at least. The COVID-19 health crisis, while...