Report: The Magnificent Seven

As the biggest-ever platform shift in modern technology unfolds, together with D...

We already covered the foundations piece in the first part of our valuation mini-series. Here we take a closer look towards the main components of a typical valuation report, and key considerations which are necessary for high-growth companies in the digital sector.

While most management teams tend to be overly optimistic when putting together a financial forecast for the purposes of a valuation, it's important to recognise that we are ultimately trying to estimate a "market" valuation in the process.

If it's going to be a challenge to persuade external parties (e.g. investors) of the business potential, any input financials will result in wildly inaccurate results regardless of the valuation model applied.

As a branch of methodologies which examine valuation from a fundamentals perspective, an accurate financial forecast is a key prior task that needs to be completed before moving further.

Three common models are asset-based, dividend discount, and discounted cash flow.

Only applicable for mature, stable industries where it's possible to easily attain the market value of the assets i.e. mostly tangible assets such as property, machinery and inventory. But technology companies have a heavy weighting towards intangibles (such as software, domains, brand).

Requires strong assumptions on the growth of both dividend and the market growth rate to be relevant. Applicable for mature companies which have predictable dividend growth rates which excludes most of the tech universe firms which tend to reinvest profit towards future developments.

While the foundations are highly theoretical, sharp focus on a realistic business plan can result in this technique providing a reasonable valuation data point for companies of all sizes, especially when combined with sensitivity analysis to assess various future scenarios.

Most analysts begin with a ratio based valuation ("Multiples") method which is simply the idea that similar assets trade at similar prices, since these techniques are quick to apply assuming that the right data is available.

Multiples are simply ratios that are calculated by dividing the estimated value of a firm by a key business metric. Some common examples of firm value are equity value (shareholders) or enterprise value (total measure without considering capital structure). The denominator is usually either Revenue, Gross Profit or EBITDA but could even be an operating metric such as monthly active users or website traffic depending on the business model.

These ratios can be determined either from observing data from publicly listed companies (usually via consensus analyst estimates) or via precedent transactions which have taken place among close peers - which can then be applied to the target being consider for a quick estimate. Best practise is to calculate an average (mean or median) for a basket of comparable peers / transactions rather than focusing on individual companies which could be temporary outliers.

It's key to note that these multiples capture many industry specific attributes in a single ratio (e.g. market growth, defensibility, potential shocks etc.) and so meaningful analysis requires finding as close comparables as possible. For example, applying the Revenue or EBITDA multiple for Walmart to value a fast-growing SaaS company is likely to significantly undervalue the target.

Valuation analysts may often apply adjustments to add a premium or a discount industry multiples depending on factors such as revenue scale, geography or a proprietary edge - especially if certain aspects of industry peers stray too far from the company under consideration.

Some of the common Enterprise Value Multiples are for example EV / Revenue, EV / EBITDA or EV / EBIT. For Equity Value we can outline P / E (earnings), P / B (book) or P / S (sales)

So what's the difference when it comes to valuation?

Multiples based on Equity Value can easily be distorted via changes in capital structure which have zero impact on the businesses prospects and overall valuation. Hence most financial experts prefer valuation techniques which focus on Enterprise Value allowing an "apples-to-apples" comparison.

For example, a share buy-back financed by debt would lower equity value and hence valuation multiples, despite there being no material impact on the daily operations of the firm.

Experts sometimes prefer to apply industry specific ratios depending on the industry. For example, if Capital Expenditure is relatively high, it might be sensible to consider EBITDA - Capex as a measure of profitability rather than EBITDA alone.

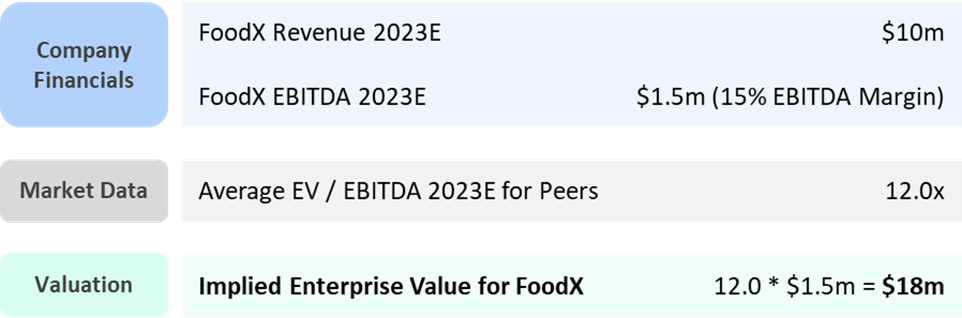

Let's suppose we are trying to value a food delivery marketplace called FoodX. The founders have bootstrapped the business without raising any external capital, and therefore have little idea of what their company is currently worth.

Management expects to pass the threshold of $10m in revenue this year with an EBITDA margin of 15%. Luckily for the team there are several public peers with companies such as DoorDash, Delivery Hero, Deliveroo, Just-eat Takeaway. A valuation expert has provided them with analyst consensus estimate data that suggests these peers are trading at an average 2023E EBITDA multiple of 12.0x.

We can take this figure to derive a quick "back of the envelope" valuation for FoodX:

This provides a starting point for the management team to further analyse the valuation of their business which is best complemented by other valuation techniques (e.g. Precedent Transactions or Discounted Cash Flow).

It's important to note that much of the theory around corporate finance and valuation assumes that data is highly accessible. In many circumstances with real-world scenarios, there are often plenty of assumptions required - with limited data disclosed from precedent transactions and listed public companies varying significantly in business model, track record, management strategy, geographies of operation etc.

As the biggest-ever platform shift in modern technology unfolds, together with D...

We are formally launching our tech sector coverage in Latin America, an ever-evo...

In conversation with Francisco Loehnert, co-founder and CEO of Awto, an autotech...

In conversation with Gabriela Estrada, co-founder and CEO of Vexi, a neobanking ...

2023 has been a wild ride in tech. From the rise of gen AI to public valuation m...

We checked in on the data and trends driving the global startup, tech and ventur...

We partnered with Dealroom to deliver the latest update on European tech ecosyst...

With the proliferation of new technologies comes the growing number and complexi...

Beyond understanding the corporate finance principles behind company valuation m...

Software as a Service (SaaS) business model has been around for a while, growing...

ARPPU, or 'Average Revenue per Paying User', is a measurement of the predicted r...

While most management teams tend to be overly optimistic when putting together f...

Company valuation is a key aspect of corporate finance that is used to determine...

South Korea is the fastest growing Asian Tiger nation for VC investment, and Seo...

Deliveroo is reported to target a $10B valuation in an upcoming IPO. In preparat...

In this report, we take a deep dive into the creator economy ecosystem to analyz...

Climate change is one of the most threatening crises of our time and the world n...

This was a pretty crazy year, to say at least. The COVID-19 health crisis, while...